The AV MBA, pt 2: A Guide to Networking for the AV Professional

It wasn’t until started a new job in my mid-thirties that required me to network that I really gave it a second thought. My new role required me to build a book of business from the ground up in my local region. I was tasked with identifying new and upcoming AV projects and positioning myself to win those contracts. I had always worked on a national scale, so this was my first foray into focusing my efforts locally. The reality set in that I had been living and working in the same place my entire life and I had never taken the time to grow my local network. Better late than never…

I needed to act fast, so I began joining every group that would have me! I joined the board of directors for my college Alma Mater, reached out to my friend that ran a large, local non-profit and got involved, contacted several local Chambers of Commerce and began attending meetings, researched when municipal planning board meetings would be taking place, and attended them armed with business cards. I even got in touch with a friend of mine in the metalwork industry who introduced me to the membership chair of two of the area’s largest construction trade associations.

I needed to act fast, so I began joining every group that would have me! I joined the board of directors for my college Alma Mater, reached out to my friend that ran a large, local non-profit and got involved, contacted several local Chambers of Commerce and began attending meetings, researched when municipal planning board meetings would be taking place, and attended them armed with business cards. I even got in touch with a friend of mine in the metalwork industry who introduced me to the membership chair of two of the area’s largest construction trade associations.

Fast-forward to today, and I’ve pared down the number of groups I’m actively involved in. However, I don’t regret the aggressive approach as it gave me the confidence to go out and spread my networking wings. I’m proud to say that I have embraced networking on both the professional and personal level, and it has enriched my life exponentially.

To begin, let’s define what I mean by “networking” in the professional world:

What is Networking?

What is Networking?

- Per Investopedia: The exchange of information and ideas among people with a common profession or special interest, usually in an informal social setting.

- My definition: An opportunity to build professional relationships with different groups of people and expand your personal brand across a targeted group, industry, or field.

What isn’t networking?

- The chance to make your sales pitch to prospective customers.

- A short-term endeavor that delivers immediate returns.

Why do people network?

The key to success in almost every professional endeavor starts and ends with people. Successful people understand that they can’t achieve their goals on their own. They must rely on their team. Think of your network as your expanded team. All the people in your network are a part of your team, and you are a part of theirs.

Next, let’s look at why we should invest our time and effort into building our network.

- The most obvious reason is to grow our business or our professional career. The good news is that developing professional relationships generally helps us with both specifically.

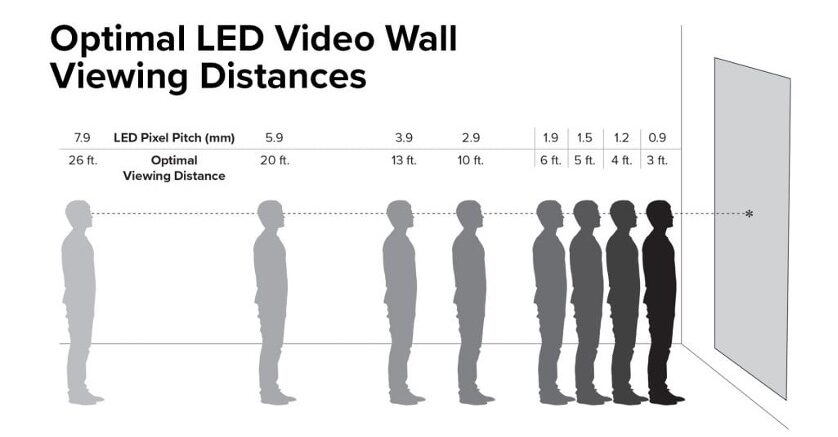

- Establishing your professional brand in the industry, group, or professional community you are networking in. For example, my goal was to become the “Audio Video Guy” that came to mind for the entire Western New York region. Today, my goal is to be the “DVLED Guy” for the Pro AV Industry.

Finally, I’d like to address how to go about developing a professional network.

Finally, I’d like to address how to go about developing a professional network.

National / Industry

- Exertis Almo E4 Shows (that’s me on the right!)

- AVIXA / InfoComm

- Smaller tradeshows and industry events

- Vendor events

Attending trade shows and industry events is a great way to meet new people with similar goals. Personally, I prefer smaller scale events as they allow for more personal, one-on-one engagement. The next time you’re at a big trade show, pay attention to opportunities to connect with others at satellite parties and happy hours. If you are visiting a vendor booth, ask the representative your are speaking with if they have plans for the evening. Many times, vendors will host small events outside of floor hours to engage with prospective customers.

Local / Industry (AV Related)

- Trade Associations

- BOMA: Building Owners and Managers Association

- Local Construction Exchanges

- Municipal Planning Board Meetings

- Create your own local AV Networking group

By working in the local AV industry in my home city of Buffalo, NY, I was able to make great connections through trade associations, like CONEX Buffalo and BOMA Buffalo. Exchanges similar to these can be found in cities all across the country. They typically hold monthly events that attract folks from all industries that serve construction projects. Not only will you be able to meet individuals from complementary fields (construction companies, electricians, office furniture suppliers, etc.), but you will be able to form relationships with the customers as well through groups like BOMA.

Additionally, I formed a group of local AV professionals in my area (vendors, integrators, distributors, and reps) and we would meet periodically over lunch or coffee to share any relevant news of projects we were working on or trends we were seeing.

Local / Professional

- Chamber of Commerce

- Boards – private companies, municipal, academic, non-profit

- Charitable Foundations

While not directly related to the AV field, just meeting local professionals, and letting them know that I worked in AV would often spark up conversations. Everyone has experienced issues with AV and tech in general, and they are often quick to bring up stories. As the adage goes, every challenge presents an opportunity.

Social Media

Keeping up your professional presence on social media is important. The chances are, you frequent LinkedIn, Facebook, or Instagram on a regular basis. These platforms draw a lot of attention, but it’s a crowded space! By commenting on colleague posts and creating your own posts, you draw attention to your profile. I try to ensure that most of my posts are at minimum related to the industry I work in and preferably, directly related to my niche. The more often that I post, the better the chance that an industry peer or colleague will think of me in the future when they have an opportunity related to my field of expertise.

A few other points:

Networking can be awkward. That’s OK. Chances are it’s a little uncomfortable for the rest of the group too. What helps me is to remember that we’re all there for the same purpose.

Networking can be awkward. That’s OK. Chances are it’s a little uncomfortable for the rest of the group too. What helps me is to remember that we’re all there for the same purpose.

- It’s reciprocal. If you only come to the party to take and you never give, you won’t be invited to many more parties! Focus on how you can help others without expecting anything in return.

- Patience is required. Relationships don’t develop overnight, and you can’t force them. You will need to invest your time, attention, and interest in others.

- Proactivity is key. It is what you make it. If you go and don’t make any connections, you get nothing. If you make connections and don’t follow up, you get little. If you make connections, ask them if they would like to continue talking over coffee sometime and follow up, then you’re on the road to a relationship!

Wherever you are on your networking journey, I hope this information gives you some ideas. As always, feel free to reach out to me directly on LinkedIn and we can continue the conversation!

About the Author

Tom Keefe | CTS, DMC-D-4K, DSCE

Business Development Manager – Brand Specialist

Supported Manufacturers: Absen

I’m in Business Development, or “Biz Dev” for short. It’s sometimes a difficult role to describe when people ask! I’ll take a stab at an answer…

I’m in Business Development, or “Biz Dev” for short. It’s sometimes a difficult role to describe when people ask! I’ll take a stab at an answer… Finally, I want to be a champion for the vendor and help spread their message to the target audience. Data analysis is a critical tool that I must employ to achieve these objectives.

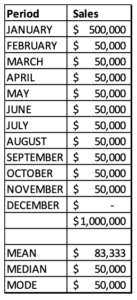

Finally, I want to be a champion for the vendor and help spread their message to the target audience. Data analysis is a critical tool that I must employ to achieve these objectives. Armed with a few basic tools, I’m able to summarize trends and figures that answer questions like, “How can I be more profitable?” “What can I do to grow my revenue?” “Can I be more efficient by cutting out certain activities that don’t produce adequate results?” “Where should I focus my time for the greatest return?” And, perhaps most importantly, “what’s working and what’s not?”

Armed with a few basic tools, I’m able to summarize trends and figures that answer questions like, “How can I be more profitable?” “What can I do to grow my revenue?” “Can I be more efficient by cutting out certain activities that don’t produce adequate results?” “Where should I focus my time for the greatest return?” And, perhaps most importantly, “what’s working and what’s not?” Organize the data. What data are we interested in evaluating? Let’s look at customer name, location, revenue, profit, products sold, date (month). Next step…

Organize the data. What data are we interested in evaluating? Let’s look at customer name, location, revenue, profit, products sold, date (month). Next step…

I remember working in the garage as a kid with my dad, and it seemed like 80% of the time we were cleaning up and 20% of the time we were actually working on a project. He would always say, “a clean workspace is a safe workspace!”

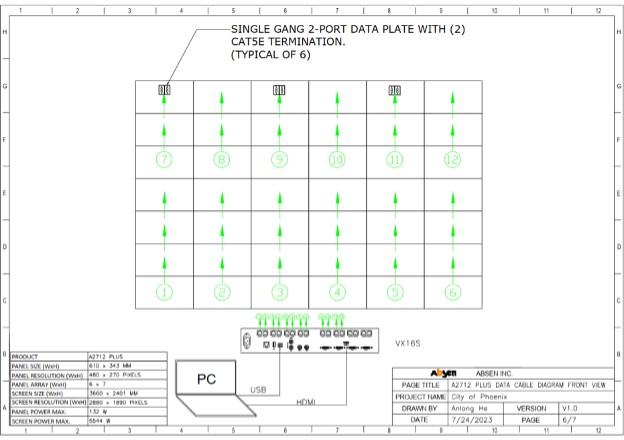

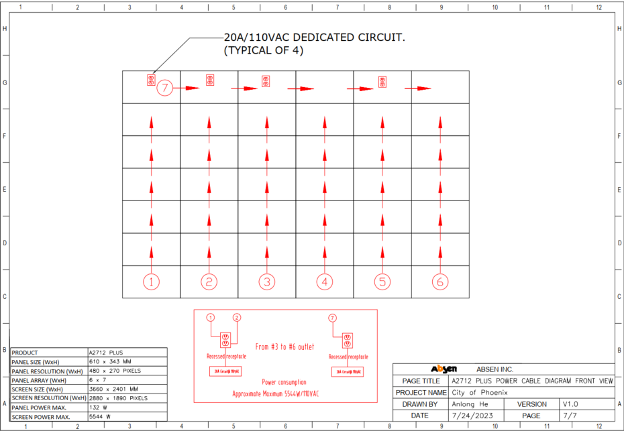

I remember working in the garage as a kid with my dad, and it seemed like 80% of the time we were cleaning up and 20% of the time we were actually working on a project. He would always say, “a clean workspace is a safe workspace!” For dvLED displays, the site prep requirements are pretty rigid, and for good reason. I’m going to discuss a few universal requirements that you will run into on almost every dvLED project.

For dvLED displays, the site prep requirements are pretty rigid, and for good reason. I’m going to discuss a few universal requirements that you will run into on almost every dvLED project.

I’m one of those people who always says “no” to any extras when I make a big purchase. I sometimes feel bad for the finance guy at the car dealership, because I know from the onset that he isn’t going to sell me on a single extra service or add-on. It’s a painful ten minutes of me smiling and saying, “That sounds great! No thank you.” If there was a poster child for the adage, “Men never ask for directions,” I’d be it. To be honest, I just feel like I’m capable and I can figure things out for myself. Admittedly, this approach has rendered mixed results at best…

I’m one of those people who always says “no” to any extras when I make a big purchase. I sometimes feel bad for the finance guy at the car dealership, because I know from the onset that he isn’t going to sell me on a single extra service or add-on. It’s a painful ten minutes of me smiling and saying, “That sounds great! No thank you.” If there was a poster child for the adage, “Men never ask for directions,” I’d be it. To be honest, I just feel like I’m capable and I can figure things out for myself. Admittedly, this approach has rendered mixed results at best… This brings me to the topic of this edition of Breaking Down DVLED, The First Step in Installing a DVLED Video Wall is Admitting you Need Help!

This brings me to the topic of this edition of Breaking Down DVLED, The First Step in Installing a DVLED Video Wall is Admitting you Need Help!